What You’ll Get

- 4-Part Video Series (3+ hours of content)

- Complete Excel Model (built from scratch)

- Real-world development scenario

- Professional modeling techniques

Download the finished Excel model below and follow along with our comprehensive video series!

DOWNLOAD EXCEL MODELWhy This Tutorial Matters

Triple Net development deals are a cornerstone of commercial real estate, and this tutorial shows you exactly how experienced professionals analyze them. Watch a seasoned CRE professional (8+ years experience at a major PE mega fund) build a complete development model in real-time, explaining every decision along the way.

Perfect for:

- Analysts preparing for CRE interviews

- Professionals transitioning to development roles

- Students learning real estate financial modeling

- Anyone wanting to see how the pros actually work

Deal Overview

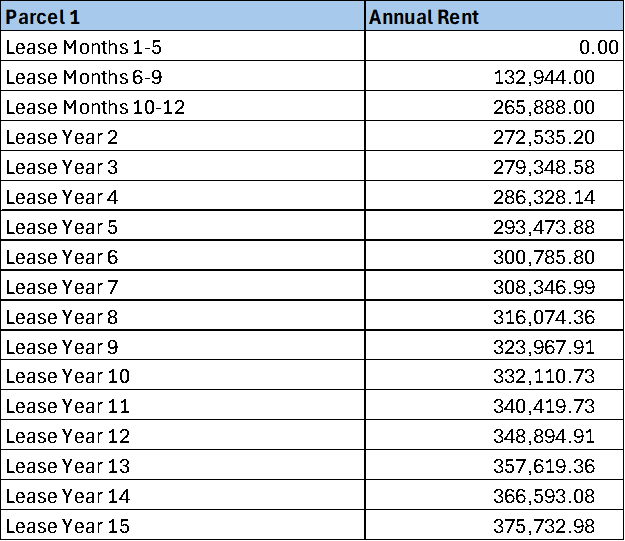

Suppose that you work at a development firm and a partner has requested a financial model to determine the viability of an approximately 16,000 square foot retail center. The center is divided into two parcels, each roughly 8,000 square feet. The partner has already reached out to prospective tenants and secured a lease at $32.80 PSF NNN for Parcel 1, but has not yet secured a lease for Parcel 2.

The partner is also interested in comparing the financial feasibility of selling both (or one) of the parcels, rather than developing the parcels. The land purchase cost is $1.2 million ($600k for each parcel), which we assume will take place on January 31, 2025. To fund the deal, your firm will contribute equity and take out a floating-rate construction loan to cover the balance of the development cost. Upon construction completion and lease-up of the space, the plan is to refinance the construction loan with a fixed-rate loan.

Model Assumptions

Note: Question marks in the development budget are intentional – these are fields you’ll calculate while building the model (they differ for each parcel).

Video Series Breakdown

Part 1: Excel Setup & Development Budget (51 min)

Watch the foundation being laid for a professional-grade model

- Project setup and organization

- Development cost schedules

- Lease term modeling

- Professional checks and error tracking

Part 2: Model Organization (5 min)

Quick adjustments and setup refinements

- Data reorganization for clarity

- Toggle functionality

- Transition to cash flow modeling setup

Part 3: Unlevered Cash Flow Analysis (48 min)

Build the core financial engine

- Monthly construction cash flows

- NO projections with actual lease terms

- Exit valuation calculations

- Scenario comparison analysis

Part 4: Construction Debt & Levered Returns (79 min)

Add sophisticated financing structures

- Construction loan with Treasury + spread pricing

- Interest reserve calculations

- Permanent loan refinancing

- Complete sources & uses schedule

Model Features & Functionality

What’s Included in the Excel Download:

- Fully dynamic monthly cash flow model

- Toggle between Build/Hold/Sell scenarios

- Automatic construction timing

- Flexible lease-up assumptions

- Complete debt modeling with circularity handling

- Professional formatting and error checks

- Sources & uses schedule

- Return metrics dashboard

Technical Skills You’ll Learn:

- SUMIFS for dynamic period summaries

- INDEX/MATCH for flexible lookups

- Circular reference management

- MIN/MAX formulas for cash flow timing

- Professional model architecture

- Macabacus shortcuts and efficiency tips

Questions for Deeper Analysis

- What are the 2-3 most important variables that impact returns on this deal? Hint: Consider lease rates, construction costs, and exit cap rates. How sensitive is the model to each?

- What is the yield on cost of the deal? How does that compare to the exit cap rate assumption? Hint: Calculate NOI ÷ Total Development Cost and compare to the 7% assumption. What does this spread tell you?

- What are the returns (IRR) in each scenario and which would you recommend? Hint: Consider both return metrics AND risk profile. Is the higher IRR always better?

- If you can get more construction debt on the deal (higher LTC), would you recommend doing so? Why or why not? Hint: Model different LTC scenarios and observe the impact on both returns and cash requirements.

- What causes the circularity in the development model? How can you solve this issue by using iterative calculations in Excel? Hint: Interest calculations create circularity. File → Options → Formulas → Enable iterative calculation.

Take Your Modeling Further

Ready to master CRE modeling? This tutorial is just the beginning.

Recommended Next Steps:

REPE Starter Kit (2 hours)

- Quick introduction to real estate private equity

- Perfect if you’re in a time crunch

- Covers fundamental concepts and industry overview

Breaking Down Real Estate Private Equity (7 hours)

- Deep dive into REPE modeling

- Build full-scale acquisition models from scratch

- Learn from professionals with $15B+ transaction experience

- 41 pages, 56 in-depth questions

- Covers all major property sectors

- Proven to help land offers at top REPE firms

Complete Bundle (Best Value)

- All 9 Leveraged Breakdowns products

- 3 months course access + permanent guide downloads

- Everything you need to break into REPE

Get the complete Excel file and start practicing today!

DOWNLOAD EXCEL MODELBy downloading, you’ll also receive our CRE Modeling Best Practices guide

Questions or Comments? Have questions about the model or videos? Drop them in the YouTube comments on any of the four videos above – we actively monitor and respond to help you learn!

Looking to learn more? Check out our various professional resources! Whether you have yet to break into the industry or are just starting out in a new role, we have everything you need. All you need to bring is your effort!

Regarding Disqus: You’re right to be cautious. Disqus can attract spam and often feels cluttered. YouTube comments are definitely cleaner and keep the engagement on the platform where the content lives. I’d recommend sticking with YouTube comments as you suggested – it’s more native to the video experience and easier to moderate.

Thanks for reading!

Getting value from our free materials? Consider supporting us on Patreon