This post kicks off our series on real estate private equity for beginners. Here, we focus on most important financial statement in real estate private equity: the trailing twelve month operating statement. You may also know this statement simply as “the TTM” or “T12.” Either way, understanding the T12 is a fundamental real estate private equity skill.

Brief Description of TTM Financials

Why did we kick off our series on real estate private equity for beginners with the T12? Because, the T12 distills every piece of important information into a single statement. You can derive average in-place rents, concessions, utility charge-backs, expense optimization, and so much more just from analyzing a single T12. Thus, understanding the T12 is a critical real estate private equity skill.

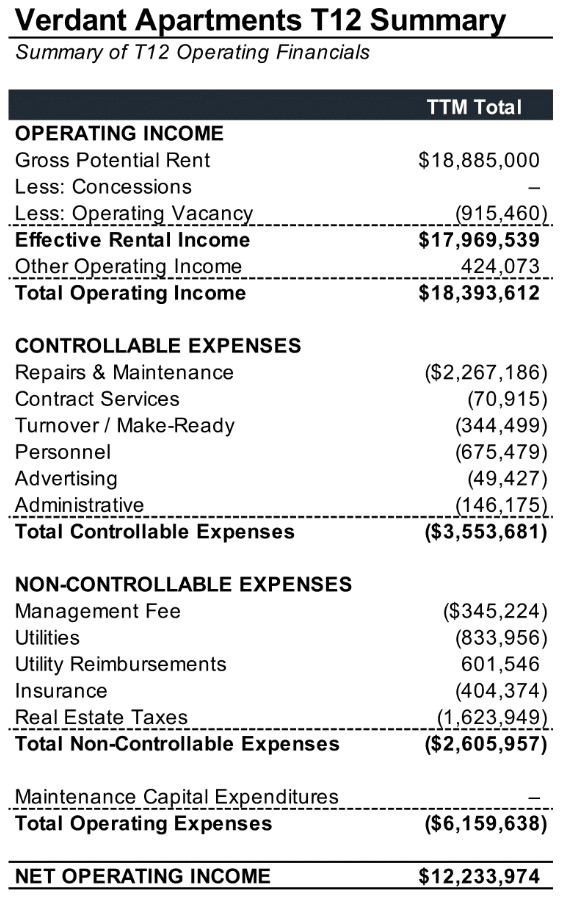

The T12 summarizes the property’s economic performance as defined by Net Operating Income (“NOI”) over the past twelve months. This statement discloses all revenues and expenses by month for an entire year. The T12 demonstrates top-line growth, operating efficiency, and high-level rent roll management all at once. You can spot seasonality trends, inclusive of the higher-performing summer months as well as the lower-performing winter months. TTM financials vary by asset class and the granularity of exposure, yet generally resemble the following:

Example of TTM Financials (from the Verdant Apartments Model)

TTM Categories

The TTM summarizes the past twelve months of operating income and operating expenses. Operating expenses are further subdivided into controllable and non-controllable expenses. This expense subdivision is helpful for investors seeking to optimize the expense load of a potential investment. Perhaps you might think the $2,267,186 of Repairs & Maintenance (“R&M”) at the Verdant Apartments is out of line and that you could spend much less if you were to invest in this property, thus turning a profit. Because R&M is a controllable expense, you could feasibly manage this expense item better than previous ownership and outperform historicals.

On the flip side, non-controllable expenses are harder to manage. You you would have a much more difficult time paying fewer taxes, insurance, or utilities since those expense subcategories are far less negotiable.

Ultimately, all this information boils down to NOI, which reflects the sum total of all reasonably recurring operating revenues and expenses. This emphasis on reasonably recurring items explains why we also include maintenance capital expenditures within NOI. If you are familiar with REIT accounting, public companies are inconsistent with their disclosure of maintenance capital expenditures. Yet as savvy real estate investors, we consider recurring maintenance capital expenditures to be a true economic expense. More on this in future updates.

Next Steps

Understanding the T12 is one of the most important real estate private equity career skills. Real estate private equity investors benchmark investment projections against these historical financials. Thus, we must fully understand this fundamental input to our financial models. Now that we understand the broad context of TTM financials, we will dive deeper into the significance of each line item. Subsequent lessons will focus on each of the income and expense items that make up our TTM financials.

Enjoying the Detail?

Leveraged Breakdowns’ courses, accessible through your membership, synthesize financial theory, real estate acumen, and Excel mastery to deliver an all-in-one course load that will set you leagues ahead of your competition. We teach tangible real estate private equity career skills used at the top megafunds. Our team of real estate private equity insiders understands your needs as an industry outsider and has developed a curriculum designed to quickly take you from zero to REPE hero.