Given that almost all real estate is financed with debt, interest rate risk can be a critical factor in the performance of a real estate deal. Like any other risk, the goal with interest rate risk is to mitigate the risk and limit its impact on the outcome of the deal. Performance of the deal should be determined by the performance of the property and not interest rate fluctuations.

This post introduces and explains two common interest rate hedging frameworks used by institutional real estate investors.

How does Interest Rate Hedging Work?

Just like wearing a seatbelt or remembering to bring an umbrella on your commute, interest rate hedging is about anticipating future risks and mitigating those risks. In practice, hedging allows investors to to reduce or eliminate interest rate exposure when acquiring real estate assets with debt.

In the context of commercial real estate, interest rate hedges are most commonly utilized on floating rate debt that exposes investors to a reference rate (typically LIBOR or SOFR). Floating rate debt leaves investors exposed to interest rate increases, which would increase the cost of debt and reduce the underwritten returns. As a result, it is common for investors to hedge all or part of their exposure to floating rate debt through the use of interest rate derivatives, commonly referred to as “plain vanilla hedges”. These hedges are discussed below.

Interest Rate Caps

An interest rate cap is a derivative instrument that pays out money once a floating reference rate crosses a certain threshold (known as the “strike”). This strike is agreed upon between the borrower and a hedge provider. The upfront cost of the interest rate cap is determined by both the distance between the current reference rate and the strike, along with the duration of the interest rate cap.

If an interest rate cap is in place and interest rates rise above the strike of the cap, the borrower will continue to make payments based on the referenced floating rate, but will be compensated by the hedge provider for the difference between the strike and the current interest rate. This effectively places a stop loss on the borrower’s interest payments in excess of the rate cap.

Below are two charts illustrating a reference rate relative to two different interest rate caps (the interest rate cap strike is set at 2.0% in Example 1 and 1.4% in Example 2). The cash flow is shown in two below boxes. In Example 1, the reference rate does NOT cross the strike of the cap, resulting in an upfront payment for the cap followed by no additional cash flows. In Example 2, the reference rate DOES cross the strike of the cap, resulting in an upfront payment, followed by subsequent cash flows paid by the hedge provider to the cap owner.

Source: JLL Real Estate Finance Hedging Strategies 2019

The main benefit of utilizing interest rate caps is that it allows investors to retain upside potential in case interest rates fall while remaining protected from significant interest rate increases. The main drawback is that there’s an upfront cost or premium paid to enter into the cap agreement.

Interest Rate Swaps

On the other hand, an investor can opt to enter into an interest rate swap agreement, which essentially transfers (or swaps) the floating rate risk to a third party (or in some cases, the lender itself) in exchange for a fixed rate. This is also known as a floating-to-fixed interest rate swap. This means that the borrower of a floating rate loan will pay a fixed rate to the swap provider and in return receive the reference floating rate for a given period of time (usually coterminous with the loan).

Swaps provide interest rate protection without any upfront costs and allow investors to underwrite their debt service with certainty, but also do not allow investors to benefit in the event that interest rates fall. In addition, swaps offer less flexibility in the event that an investor wants to exit the loan/deal early. Once the swap agreement is entered into, the derivative instrument is marked-to-market daily. Depending on how interest rates move, the mark can be unfavorable for the investor and result in high breakage costs to exit the swap agreement.

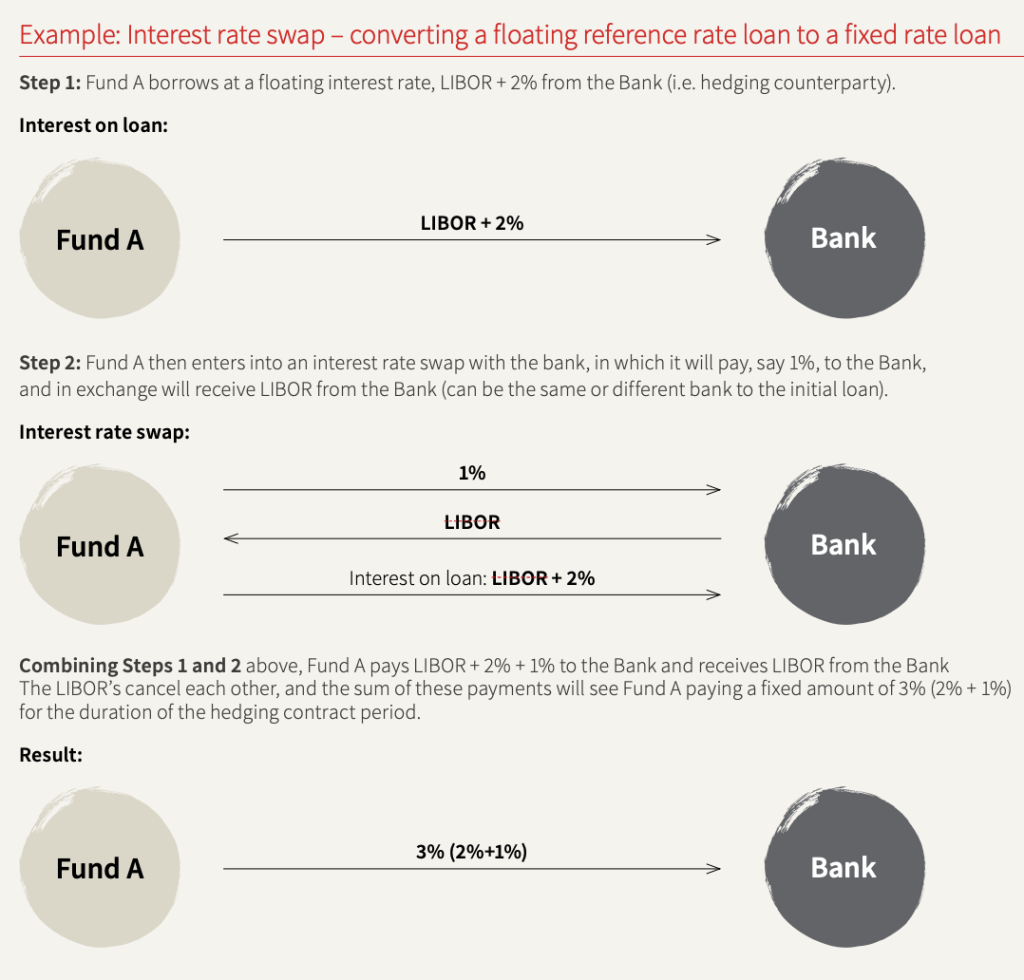

Below is an example where Fund A enters into a floating rate loan at LIBOR + 2% with a bank. Fund A separately enters into a floating-to-fixed interest rate swap, where the investor pays 1% fixed and receives floating LIBOR in return. In this case, both transactions are with the same counter party, but often the swap provider will be a third party institution. In this example, Fund A is able to lock in their interest rate at 3% fixed rate (1% fixed from the swap + 2% spread).

Source: JLL Real Estate Finance Hedging Strategies 2019

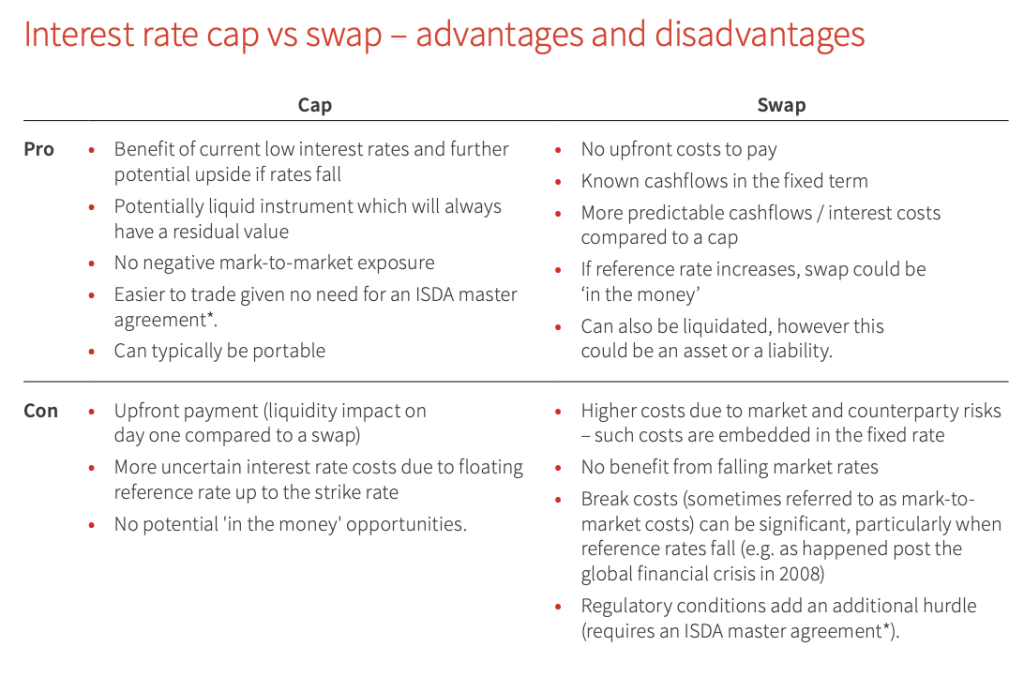

JLL provides a great summary of the pros and cons of each hedging strategy and their potential impacts on a transaction, below.

Source: JLL Real Estate Finance Hedging Strategies 2019

Final Thoughts

Here’s a final question to consider: in a rising interest rate environment, which type of interest rate hedge instrument is likely to be more attractive for borrowers? A cap or a swap? Why?

As illustrated above, it is important to understand the nuances of each hedging instrument in order to make informed decisions about the type of debt and hedges that are used in a deal.

Looking to learn more? Check out our various educational resources! Whether you’ve yet to begin a formal real estate interview process or are crunching through real estate interview questions at the last minute, we have everything you need. All you need to bring is your effort.